Agents that deliver outcomes. Ledgers that prove it.

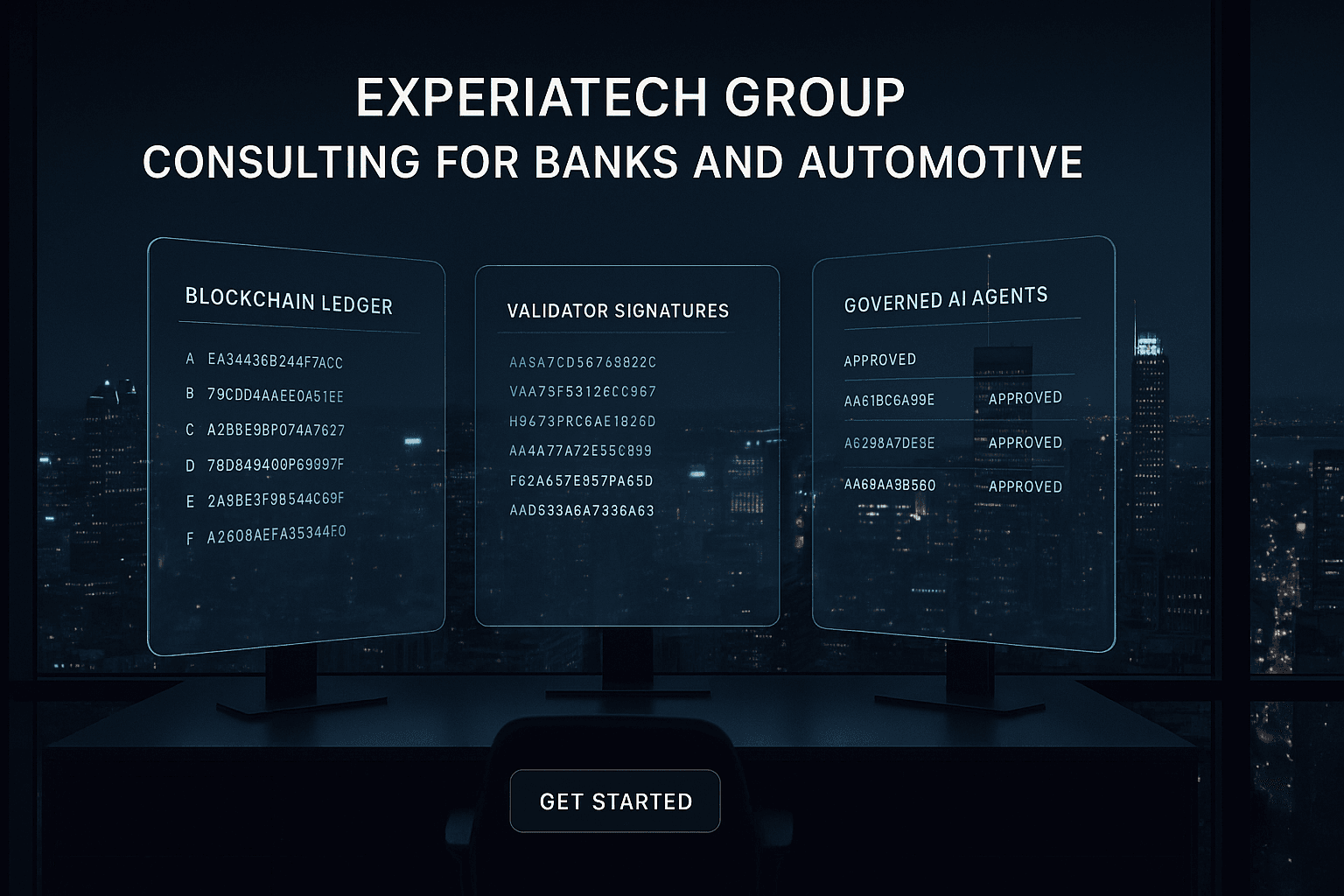

Experiatech helps banks and automotive leaders deploy governed agentic AI, blockchain-grade audit trails, and cloud platforms—without breaking existing operations.

Cross-border payment (CAD→USD)

AML screening + sanction check

Validator: Bank Pilot 01

Evidence pack ready (CSV + hash)

Book of Records — live view

HealthyEntries today

12,480

Validators

4 (consortium)

p95 latency

420 ms

Latest evidence pack: hash 0x9f6c…a3f2 • Signers: 3 validators • Export ready (CSV + proof)

Capabilities

Four pillars that prove outcomes

Governed agents, audit-grade ledgers, products that wrap your stack, and cloud guardrails tuned for regulated teams.

AI Agents

Governed agent marketplace with human-in-the-loop approvals, policy checks, and full observability.

- Role-based controls

- Audit-grade event logs

- Safe tool access

Blockchain

Permissioned ledgers for auditability, integrity, and non-repudiation. Hybrid on/off-chain for privacy.

- Immutable proofs

- Selective disclosure

- Regulatory evidence packs

Software Products

Book of Records registry and operational dashboards that wrap existing systems without rewrites.

- API-first

- Evidence exports

- Resilient data plane

Cloud

Landing zones, DevSecOps, and observability tuned for regulated workloads across Canada and Europe.

- Guardrails by default

- FinOps insights

- 24/7 runbooks

Featured product

Book of Records

Audit-grade registry for financial and operational flows.

Evidence-ready by design

- Immutable log with timestamps, digital signatures, and exportable evidence.

- Contributor / validator / auditor roles mapped to your controls.

- Hybrid design: hashes on-chain, sensitive fields off-chain with encryption.

- SDK + REST API for rapid ingestion and retrieval.

Architecture

Systems

Core banking, ERP, telematics

Ingestion API

Normalize + hash payloads

Permissioned Ledger

Proofs, ordering, signatures

Audit Portal

Search, export, attest

Industries

Built for regulated sectors

Banking and automotive leaders ship faster with a shared evidence layer and governed automation.

Banking & Capital Markets

ExploreShadow ledger pilots, reconciliation automation, and evidence that satisfies CIRO/OSFI expectations.

Automotive

ExploreCloud-to-edge visibility, software-defined vehicle pipelines, and engineering agents with approvals.

How we work

Discover → Design → Build → Operate

01

Discover

Map flows, controls, and data residency with your compliance lead.

02

Design

Threat model, target architecture, and consent/off-chain strategy.

03

Build

Stand up ledger, chaincode/logic, APIs, and dashboards with CI/CD.

04

Operate

Runbooks, monitoring, and improvement sprints with your teams.

Governed AI

Approvals, guardrails, and full observability

Every agent action is policy-checked, logged, and attestable. Built for regulators and safety teams.

Approvals & guardrails

Human approvals, policy checks, and safe tool scopes per role.

Observability

Full trace of prompts, actions, and outcomes for compliance sign-off.

RBAC everywhere

Granular roles for creators, reviewers, and operators.

Data boundaries

Tenant isolation, masking, and PII minimization.

Engagement models

Start small, expand with evidence

Advisory Sprint

2–3 weeks to align stakeholders, architecture, and risk mitigations.

Build & Launch

MVP of Book of Records or agent catalog delivered with your engineers.

Managed Improvement

Quarterly roadmap, reliability SLOs, and feature increments.

FAQ

Questions teams ask before launching

What auditors, compliance officers, and engineering leads want to know before green-lighting a build.

How do you keep sensitive data off-chain?Open

We hash payloads before writing to the ledger and keep identifiers and PII in encrypted off-chain stores with rotation and access logs.

Which blockchain frameworks do you support?Open

We prefer Hyperledger Fabric for consortium ledgers and can deliver on Corda if bilateral privacy is required.

What evidence can auditors export?Open

Timestamped transaction proofs, signer identities, and CSV/JSON exports of ledger entries with verification hashes.

How fast is implementation?Open

Pilot deployments land in 8–12 weeks with managed cloud and a bank or fintech partner acting as validator.

Do agents run with human-in-the-loop?Open

Yes. Every risky action requires approval; all actions are logged with role, policy result, and provenance.

Can you integrate with existing SIEM and observability stacks?Open

We emit structured events to your SIEM and expose OpenTelemetry traces for every API call and agent action.

Where is data hosted?Open

Default is Canada-based cloud regions; France/EU hosting available for the subsidiary. Residency is configurable per client.

How do we engage?Open

Start with a discovery call (contact@experiatech.group or https://calendly.com/experiatech/discovery) to scope flows and controls.

Ready to see governed agents and audit-grade ledgers together?

Start with a discovery call to map your flows, controls, and data residency needs.